Shares of U.S. chipmaker Nvidia plummeted 17% at the start of the week due to competition from a low-cost Chinese AI startup, causing the CEO’s net worth to plunge.

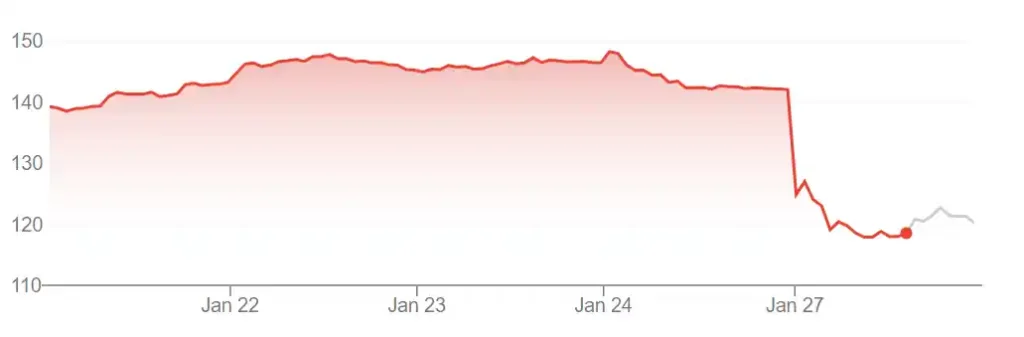

At the close of trading on January 27, Nvidia’s stock dropped 17% to $118.5. This marked the steepest decline for the stock since March 2020, during the early days of the pandemic. The sell-off wiped nearly $600 billion from Nvidia’s market capitalization, the largest single-day loss in U.S. corporate history.

The net worth of Nvidia CEO Jensen Huang also fell by $20.1 billion, leaving him with $101 billion. This drop pushed him down to the 15th richest person in the world, according to the Bloomberg Billionaires Index.

On January 27, shares of major U.S. tech companies were sold off as investors grew concerned about the emergence of DeepSeek, a low-cost Chinese AI startup. In late December, DeepSeek launched its open-source, free-to-use large language model, DeepSeek V3, which the company claims took just two months and less than $6 million to develop. The model was built using Nvidia’s H800 chips, which were downgraded in performance to comply with U.S. export restrictions.

This development has raised fears among investors that the global AI race will intensify. There are also concerns that spending on AI chips may soon peak.

Nvidia currently dominates the global AI chip market, holding an 80% share. Despite a recent slowdown in revenue growth, the company reported a doubling of revenue in Q3 2024 compared to the same period last year, reaching over $35 billion. Tech giants like Alphabet, Meta, and Amazon have spent billions on Nvidia’s AI chips to train and run their AI models.

Last year, Nvidia’s stock surged nearly 240%, and in 2024, it rose by 171%. The company briefly overtook Apple three times to become the world’s most valuable company. However, the recent sell-off caused Nvidia to lose this title to Apple. Nvidia is now the third most valuable company globally, behind Apple and Microsoft.

Jensen Huang, 62, founded Nvidia in 1993 to produce graphics chips for 3D gaming. For decades, this remained the company’s core business. Recently, Nvidia has expanded into other areas, such as the metaverse and chips for cryptocurrency mining.

Huang joined the $100 billion net worth club on June 4, 2024. Six years ago, his stake in Nvidia was worth just $3 billion. Today, that figure has grown exponentially. He also purchased additional shares when the stock hit its lows before the AI boom began.

In addition to Nvidia, shares of another major U.S. chipmaker, Broadcom, also fell by 17% on January 27, wiping $200 billion from its market capitalization.

Stocks of data center providers reliant on Nvidia’s chips also experienced a sell-off. Dell, Hewlett Packard Enterprise, and Super Micro Computer each dropped at least 5.8%. Oracle fell by 14%, causing CEO Larry Ellison’s net worth to drop by $22.6 billion—the largest decline of any individual that day.