Bitcoin halving is one of the most anticipated events in the cryptocurrency world, significantly influencing Bitcoin’s supply and price. Understanding what Bitcoin halving is and its implications can help traders make informed decisions in this dynamic market.

What is Bitcoin Halving?

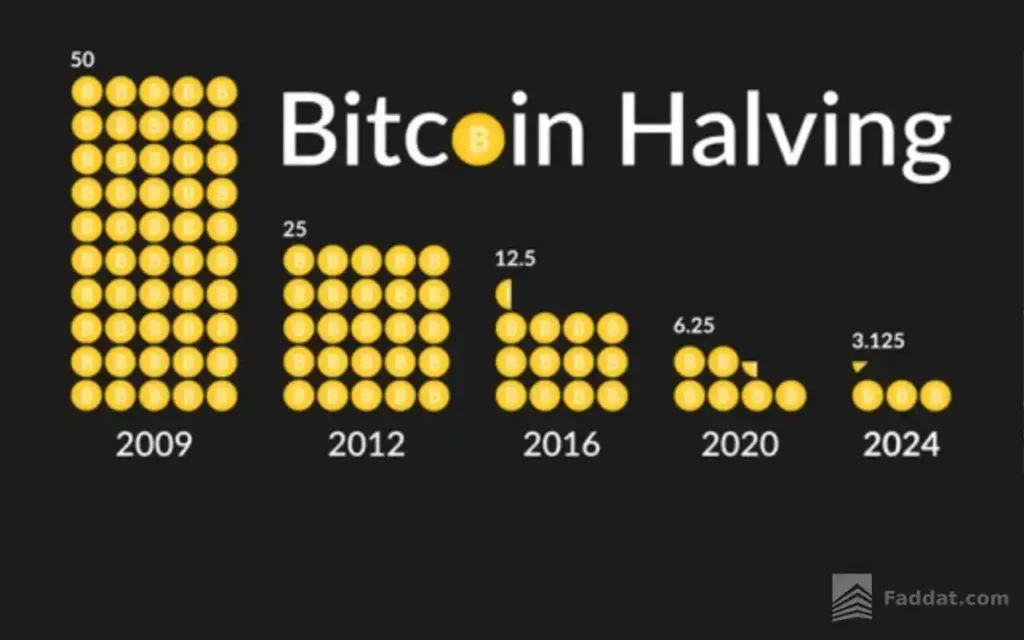

Bitcoin halving refers to the process of reducing the reward miners receive for validating Bitcoin transactions by half. This event occurs approximately every four years or after every 210,000 blocks are mined. Halving is built into Bitcoin’s code to control its supply, ultimately capping the total number of Bitcoins at 21 million.

For instance, when Bitcoin launched in 2009, miners received 50 BTC per block. This reward was reduced to 25 BTC in 2012, then 12.5 BTC in 2016, and 6.25 BTC in 2020. The next halving, expected in 2024, will reduce the reward to 3.125 BTC per block.

Why is Bitcoin Halving Important?

Bitcoin halving plays a crucial role in maintaining its scarcity, similar to precious metals like gold. By cutting the mining rewards, the rate at which new Bitcoin enters circulation slows, increasing its rarity and potentially driving up demand.

Impact of Bitcoin Halving on Cryptocurrency Traders

1. Price Volatility

Historically, Bitcoin’s price tends to rise after halving events. The reduced supply and increased demand often create bullish sentiment, leading to price surges. However, the market can also experience high volatility during this period.

2. Increased Mining Costs

As mining rewards decrease, miners must rely more on transaction fees to sustain profitability. This can lead to higher transaction costs and influence the overall mining landscape.

3. Market Sentiment

Halving events often generate significant media coverage and market buzz, attracting new traders and investors. This heightened interest can lead to speculative trading and increased market activity.

4. Long-Term Scarcity

For long-term investors, Bitcoin halving reinforces its status as a scarce asset. This scarcity can enhance Bitcoin’s appeal as a store of value, particularly in inflationary economic conditions.

How Should Traders Prepare for Bitcoin Halving?

- Monitor the Market: Keep an eye on price trends and market sentiment leading up to the halving.

- Diversify Investments: Consider balancing your portfolio with other cryptocurrencies or assets to mitigate risks.

- Understand Volatility: Be prepared for potential price swings and adjust your trading strategies accordingly.

Conclusion

Bitcoin halving is a critical event that shapes the cryptocurrency market by reducing Bitcoin’s supply and influencing its price dynamics. For traders, understanding its impacts can provide valuable insights and opportunities in the evolving crypto landscape.